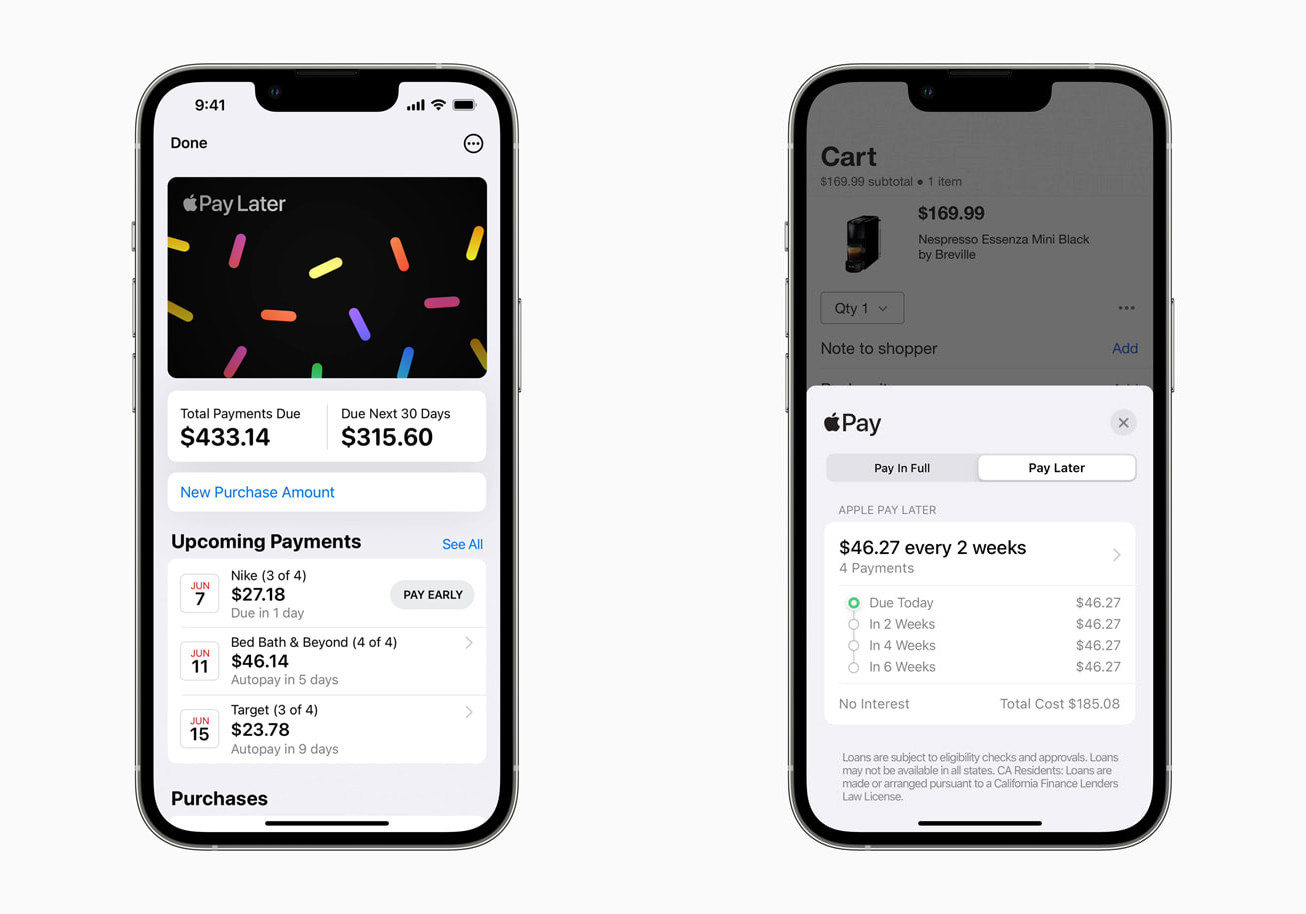

The BNPL feature will let users in the US split any purchase into four equal payments spread out over six weeks, with customers paying only a quarter of the full amount upfront while the rest is paid every two weeks. This will be available for checking out with Apple Pay and the Wallet app, either online or in-app using the Mastercard network. The tech giant promises zero interest on the instalments as well as zero fees, making it attractive for those who might not be able to afford to pay a huge amount in one lump sum. That being said, BNPL services can sometimes be a risk for younger people as Generation Z makes up 73% of its customers, with 43% reportedly missing at least one payment that may incur overdraft fees. Apple revealed that it plans on funding the BNPL loans from its own funds, the exact mechanism of which will be decided by its treasury department. While it has previously partnered with traditional banks such as Goldman Sachs for some of its financial ventures such as the Apple Card credit card, the company has a new subsidiary called Apple Financing LLC to handle Apple Pay Later. Through the subsidiary, Apple will be handling credit checks and loan decisions on its own without a partner bank for its BNPL feature. Of course, since Apple Financing does not have a bank charter, Goldman Sachs and Mastercard will still play a role in the Pay Later scheme as the payment credential issuer. Earlier this year, Bloomberg reported that Apple was working on an aptly-named “Breakout” initiative, which aims to move the company’s financial products away from outside partners into in-house services. While Apple Pay is currently available in several dozen countries, the company has not mentioned whether Apple Pay Later will be made available outside the US. (Sources: Apple, Bloomberg, Reuters)