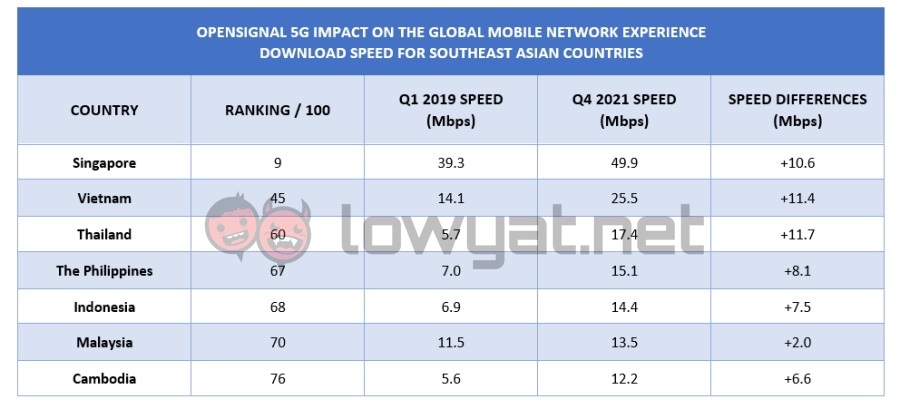

While Opensignal did acknowledge the rollout of the national 5G network by Digital Nasional Berhad that took place in the middle of December last year, Malaysia was still deemed as a market that has “no 5G influence” in all of the charts contained within the report. For clarity, here are the classifications that have been given to all of the Southeast Asian countries featured in the report: Earlier 5G Market: Thailand, The Philippines Later 5G Market: Indonesia, Singapore No 5G Influence: Cambodia, Malaysia, Vietnam, Brunei, Laos, and Myanmar are not part of the 100 markets covered by the report. Among the key data that the report focused on is the differences between the download speed experience in Q1 2019 and Q4 2021 which uses data that was collected from 1 January to 30 March 2019 as well as 1 October to 29 December 2021. Once again, we went through it to find all of the Southeast Asian countries and then compiled them into the table below:

As you can clearly see, Malaysia has the second slowest download speed in Q4 2021 even though we were the third fastest SEA country in Q1 2019. Furthermore, the difference in the download speed between the two periods was very minuscule at just 2.0Mbps. Does this mean Malaysia needs 5G to improve the state of its mobile Internet? Based on the data from the two other SEA countries that Opensignal has classified as non-4G markets, 5G may not be the immediate answer.

For example, Vietnam has already surpassed Malaysia way back in 2019 and was able to increase the gap further by the end of 2021 just using 4G. Cambodia is also not a 5G market but its download speed has improved tremendously in just two years and is only 1.3Mbps slower than Malaysia. That being said though, DNB has already aimed to expand Malaysia’s 5G coverage to around 40% of the country’s populated area by the end of 2022, although we still haven’t heard from the government whether they will retain the Single Wholesale Network plan or otherwise. Meanwhile, there is also the ongoing implementation of JENDELA Phase 1 that is meant to boost the country’s 4G speed to 35Mbps* within the same timeframe.

Perhaps, the figures may look quite different once both of these massive telco infrastructure projects are completed. So, let’s see how Malaysia will fare against its neighbours once that time comes. *It is important to note that MCMC uses Ookla’s Speedtest as the main metrics for JENDELA but not Opensignal. So, there are some differences in terms of methodologies and figures. In fact, the median mobile download speed for Malaysia in December 2021 according to Speedtest is 25.19Mbps which is significantly higher than Opensignal’s figures.